March 18, 2016

Did central bankers make a secret deal to drive markets? This rumor says yes

by Sara Sjolin

Marketwatch.com

The dollar has taken a surprisingly big stumble in recent weeks, prompting traders to ask: Whatâs really driving the selloff? The answer some are coming up with smacks of conspiracy theory.

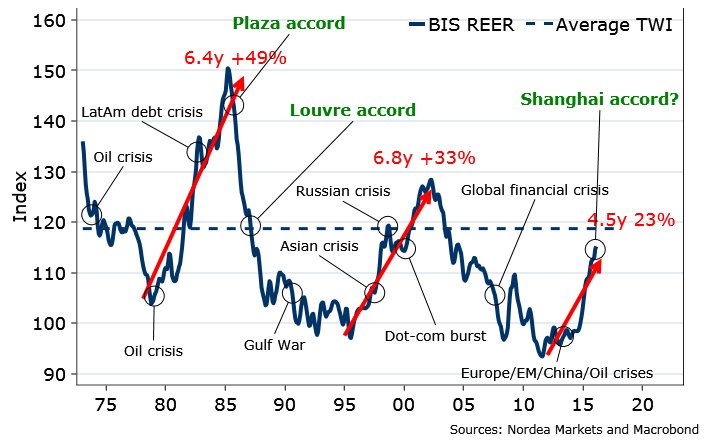

Rumors are flourishing that global policy makers made a secret deal at the G-20 meeting in Shanghai late last month. This âShanghai Accordâ to weaken the greenback was aimed at calming the financial markets, which had gotten off to an awful start to the new year, according to the chatter.

No foreign-exchange pact was announced at the February meeting of central bankers and policy makers from the 20 largest economies. That hasnât stopped speculation that a plan of action was whipped up behind closed doors, as its supposed effects are beginning to emerge now: The greenback has shaved off more than 3% since the gathering, sparking a rally in stocks, emerging markets assets and commodities.

âTo any conspiracy theorists, itâs all become quite clear,â said Chris Weston, chief market strategist at IG, in a note Friday. âThere is a global coordinated central bank effort to weaken the [dollar] in play, which in turn has led to a massive de-risking in equity and credit markets.â

âA weaker [dollar] has been a key reason why we have seen a 54% rally in U.S. crude and 40% rally in Brent â he noted.

The theorists argue a strong dollar would be bad for the global economy and could spark market volatility â ringing alarm bells with policy makers after the greenbackâs strong 2015 rally.

The dollar index jumped almost 10% last year. In December, it reached its highest level in more than a decade on expectations the Federal Reserve would start to increase interest rates.

This 2015 run-up sent ripple effects through financial markets, with emerging markets and U.S. exporters suffering in particular. Oil prices were also hit, although the substantial decline in crude futures was largely due to a persistent supply glut.

Unexpected moves

Another argument is that central bankers have made some unexpected moves recently, taking markets by surprise.

âSince the G20 meeting in Shanghai there have been many red flags,â noted Weston. âWhether itâs the [Peopleâs Bank of China] easing the Reserve Ratio Requirements (RRR) by 50 basis points, the [Reserve Bank of New Zealand] cutting its cash rate by 25 basis points (very much out of consensus), or the ECB moving to a focus on credit markets and going significantly above and beyond expectations.â

This week the Fed struck a surprisingly dovish tone and hinted it would significantly slow the pace of rate hikes year. The comments sparked a selloff in the dollar, with some market observers seeing it as another evidence of the secret âShanghai Accordâ.

Plus, there is something of a precedent: The Plaza Accord. In 1985, the finance ministers from the U.S., France, West Germany, Japan and the U.K. made a deal to jointly guide the dollar lower against the yen and the German mark.

The action was meant to help jump-start the U.S. economy by reversing an extended run-up by the greenback.

Joachim Fels, global economic adviser at bond-trading firm PIMCO, told Bloomberg he also suspects central bankers have coordinated their actions to prevent the dollar from growing stronger.

âThere seems to be some kind of tacit Shanghai Accord in place,â he told the news outlet. âThe agreement is to roughly stabilize the dollar versus the major currencies through appropriate monetary policy action, not through intervention.â

However, not everyone agrees something is afoot. Esty Dwek, global strategist at Loomis, Sayles & Co., said sheâd be surprised by a secret deal and that she hasnât heard anything about it.

Instead the recent dollar weakness comes down to two other factors, she said.

âFirst of all, the dollar has had a huge rally over a number of years,â she said. âAnd second, historically, what we see often is that the dollar actually stops rallying once the Fed starts hiking. It rallies before [rate increases].â

http://www.marketwatch.com/story/did-central-bankers-make-a-secret-deal-to-drive-markets-this-rumor-says-yes-2016-03-18

Gold is $1,581/oz today. When it hits $2,000, it will be up 26.5%. Let's see how long that takes. - De 3/11/2013 - ANSWER: 7 Years, 5 Months