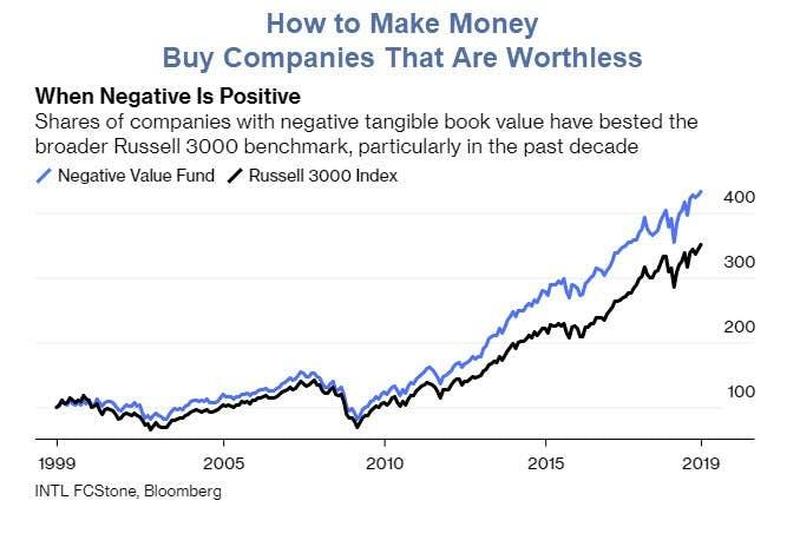

Companies with tangible net value of less that zero have increasingly outperformed the market for decades.

Bloomberg comments Capitalists Without Capital Are Ruling Capitalism

Some 40% of public stocks quoted in the U.S. have negative tangible book value,meaning that their tangible assets aren’t worth enough to repay all their debt. Two decades ago, this was only true of 15% of companies, according to Vincent Deluard of INTL FCStone Inc., who has carried out intensive research on the subject.

http://www.investmentwatchblog.com/how-to-make-money-in-this-market-buy-companies-that-are-worthless/

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.