Something remarkable happened when the Fed announced "NOT QE": starting that week, every time the Fed's balance sheet rose, so did the S&P. And the one week when the Fed's balance sheet shrank, the market dropped. Yes, correlation may not be causation, but if a pattern repeats 9 weeks out of 9, then it becomes feedback loop which the math PhDs plug into their various algo/quant models and... voila:

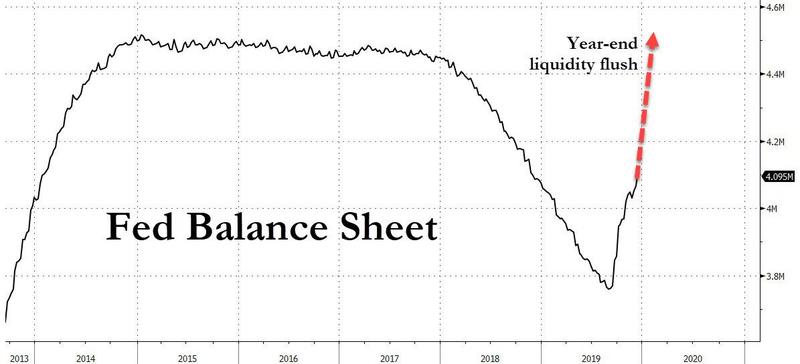

Which begs the question: yesterday we reported that as part of its year-end repo bailout operation, the Fed plans on injecting over $500 billion of liquidity in the next 4 weeks, a process which will take the Fed's balance sheet sharply higher by roughly $500 billion through mid-January, in the process pushing the balance sheet to a new all time high above $4.5 trillion. We wonder: just what will happen to stocks?

http://www.zerohedge.com/markets/market-week-just-ask-feds-balance-sheet?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.