While there was initially a lot of superficial debate whether the Fed's POMO operations coupled with massive and ongoing Repo scramble which bloated its balance sheet by almost $300 billion in under two months was QE 4 or, as the Fed claims, NOT QE, fervent Fed fanboys (who bizarrely are largely of the socialist persuasion) suffered a substantial defeat last week when first Bank of America admitted that NOT QE is in fact QE, and then even the Fed's biggest fans over at Bloomberg admitted that the "Fed's fix for repo turmoil may be helping the rally in stocks" (yes, injecting $60 billion in liquidity each month may have an impact on risk assets; go figure). But the nail in the coffin came earlier this week when Nordea's Andreas Stena Larsen said that If it walks like a duck and talks like a duck, then it probably is QE.⦠or thatâs at least how the market has chosen to interpret the balance sheet increase from the Federal Reserve.

As the Nordea analyst explains, the reason why individual opinions are irrelevant, is because just one opinion matters: "the QE narrative is fully adopted by the market" and proceeds to dig the grave for the "NOT QE" crowd a few extra inches deeper, saying that "the Fed had the chance to âcorrectâ the 60Bâs extrapolators this week but refrained from doing so (they will buy 60Bâs the next 30 days as well)."

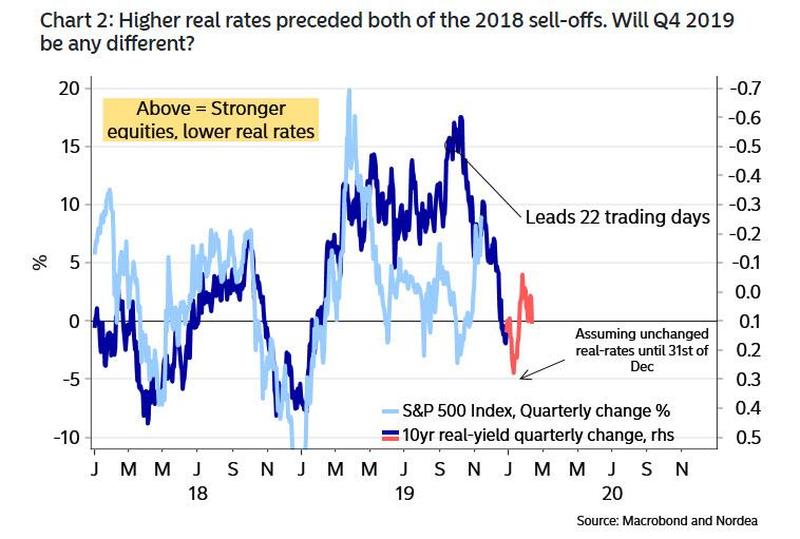

As a result, "the market is partying like it is a massive liquidity addition" yet as we noted earlier this week, Nordea is perplexed by the furious market response, which appears to be pricing in both QE4 and QE5, and points out that the party is getting slightly out of hand, as the S&P 500 would be up more than 30% y/y by Christmas, assuming unchanged S&P 500 levels from here.

This, as Larsen adds, is stunning as such yearly increases "have usually gone hand in hand with much bigger liquidity increases than we are seeing right now." His conclusion: "there is clearly a FOMO in markets on the asset pricing positivity, stemming from the soft QE from the Fed." To which we can only say that it's obviously not so "soft" if it has resulted in one of the best years since the financial crisis.

http://www.zerohedge.com/markets/if-it-walks-duck-and-talks-duck-then-it-probably-qe?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.