If there is a melting ice cube among America's established blue chip companies, none is greater than IBM.

After a modest rebound in the company's top line one year ago, IBM has relapsed to its old, top-line shrinking ways, and after the close reported revenue of $18.028BN, down from $18.756BN a year ago, below the $18.22BN estimate, and the lowest quarterly revenue since the first quarter of 2002! This means that despite its massive investment in various next generation technologies, IBM just reported the lowest revenue in over 17 years of $18.03 billion.

Total revenue was down 3.9% Y/Y, and represented the 5th consecutive annual drop and 27th of the past 30.

To be sure, while core revenue streams such as Global Technology Services and Systems continued to decline (down 5.6% and 14.7%, respectively), there were some positive surprises, mostly in Cloud and Cognitive Software and Global Business Services, to wit:

Cloud & Cognitive Software (includes cloud and data platforms which includes Red Hat; cognitive applications; and transaction processing platforms) â revenues of $5.3 billion, up 6.4%, led by security, IoT, data and AI platforms and hybrid cloud; cloud and data platforms, up 17%; cognitive applications, up 4%; transaction processing platforms, down 5%

Global Business Services (includes consulting, application management and global process services) â revenues of $4.1 billion, up 1.0%, led by growth in consulting, up 4% as gross profit margin increased 110 basis points.

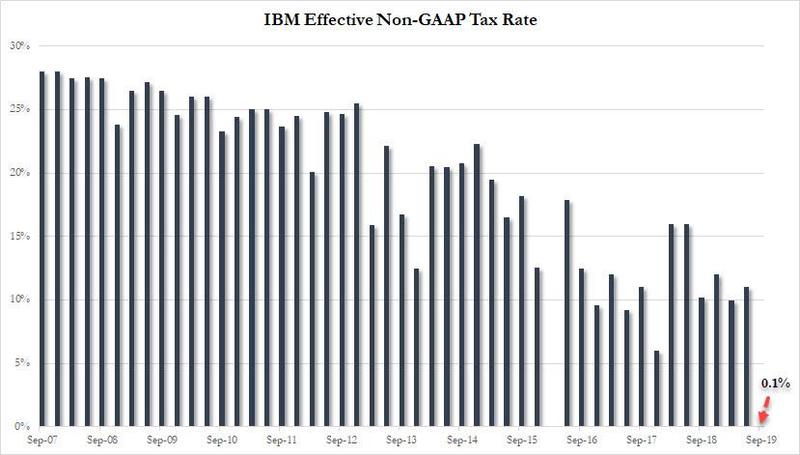

As usual, however, it wasn't just a top-line story: in its attempt to beat non-GAAP EPS expectations at all costs, which the company did by the smallest of margins, reporting adjusted EPS of $2.68, one cent above the $2.67 expected, which was still down 22% Y/Y, the company resorted to what has become the oldest trick in its book: fudging the tax rate, and in Q3, IBM reported an effective GAAP tax rate of -9.9% (yes, negative, thanks to a $151MM benefit from income taxes), vs positive 10.2% a year ago, and which after various non-GAAP adjustments ended up being the smallest possible positive non-GAAP tax rate of just, drumroll, 0.1%! That's right, had IBM applied a tax rate even remotely close to what it used in prior quarter, it would have missed badly on the bottom line. Good job tax accountants!

So with all that, how did the stock do? In a word, or rather two, not good: IBM tumbled over 5% to $135 after hours...

... just $5 away far from where IBM traded back in July 2008, just before the financial crisis.

http://www.zerohedge.com/markets/ibm-plunges-after-reporting-lowest-revenue-17-years-eps-beats-01-tax-rate?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+