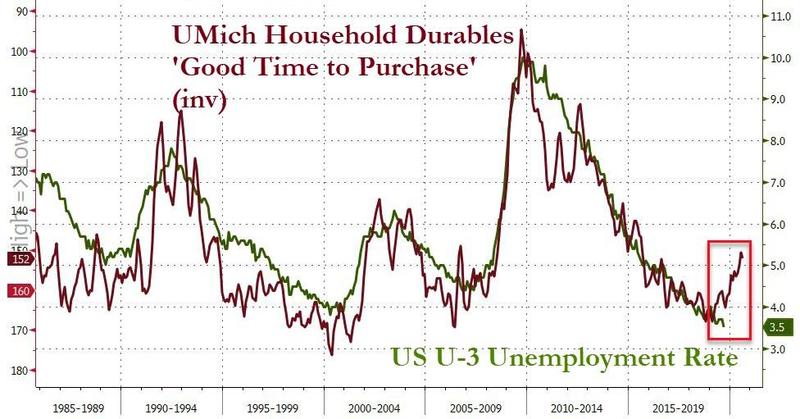

One of the perplexing divergences about the ongoing economic slowdown is that whereas manufacturing, and increasingly, service surveys have shown the US economy is on the verge of a contraction, the US consumer remains quite healthy.

Indeed, as Morgan Stanley wrote yesterday, the strength of the US consumer has been the bedrock of the current economic expansion. Just a few weeks ago, in a CNBC interview, Fed Vice Chair Clarida said that âI cannot think of a time where in the aggregate the consumer has been in better shape.â With unemployment at 3.5%, the household savings rate ticking up to 8%, the aggregate debt-to-income ratio hovering around 40-year lows and consumer delinquencies at or near post-crisis lows, policy-makersâ comfort with the strength of the US consumer seems well grounded.

That said, cracks are appearing, and while aggregate consumer debt-to-income ratios and delinquency rates are indeed low, the New York Fedâs financial obligations ratio tells a different story. With the decline in homeownership, the share of rental households has risen, as have rents, which are not included in aggregate debt-servicing costs. In addition to standard debt payments, the financial obligations ratio includes payments towards rent, auto leases, homeowners' insurance and property tax payments, with rents representing the bulk of these non-standard obligations.

http://www.zerohedge.com/economics/measure-us-unemployment-about-surge

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.