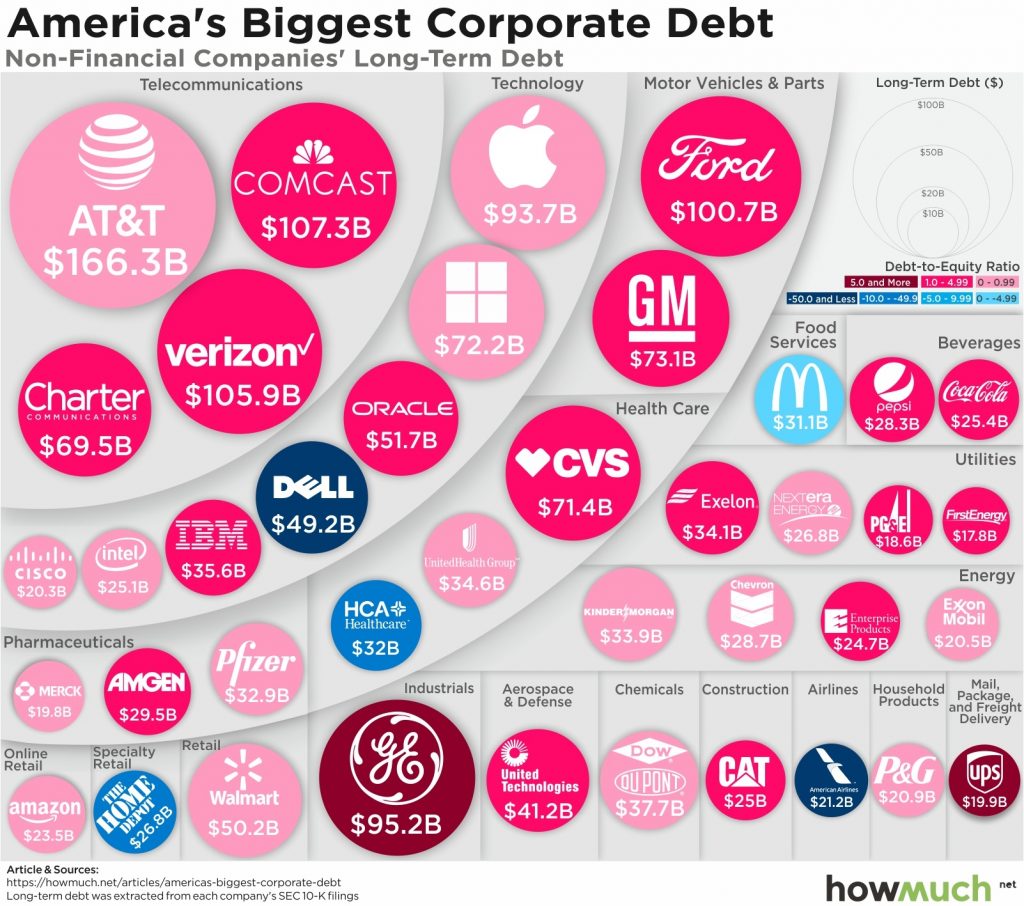

The following visualization, from the cost-estimation website HowMuch.net, shows the largest non-financial corporate debts in the United States based on data from 24/7 Wall Street.

Since the Financial Crisis, the United States has witnessed the largest increase in corporate indebtedness on record, a by-product of a decade of artificially low interest rates. The graphic above helps visualize one part of that indebtedness: long term corporate debt. The graphic groups companies by sector and colors them based on their debt-to-equity ratio, with dark red signifying a higher debt-to-equity ratio and blue signifying a low ratio.

The three companies with the highest long term debt are all telecommunications companies: AT&T ($166.3 billion), Comcast ($107.3 billion), and Verizon ($105.9 billion). Following these companies is Ford ($100.7 billion) and GE ($95.2 billion). While GE is famously indebted, some of its debt is from its financial business, making it an apples-to-oranges comparison vis-a-vis other non-financial companies.

The companies with the highest debt-to-equity ratios are: GE (8.35), UPS (6.56), Ford (2), First Energy (2.61), and Amgen (2.36).

The question moving forward is how financial markets can continue to simultaneously fund swelling corporate and government bond markets when the monetary base in the US is actually shrinking due to the Fedâs balance sheet reductions.

more,,,,,,,,,,,

http://thesoundingline.com/americas-biggest-corporate-debtors-in-one-chart/

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.