Following up on our previous article discussing the unexpected collapse of US corporate operating profits in yesterday's post-revision GDP data, JPMorgan makes an interesting observation.

First the good news. As we noted on Friday morning, US GDP grew more rapidly than expected last quarter as a strong 3.5% rise in domestic final sales offset a large drag from net trade and inventories. However, the slowing in stock building was less than expected and corporate efforts to lower its pace further likely will continue.

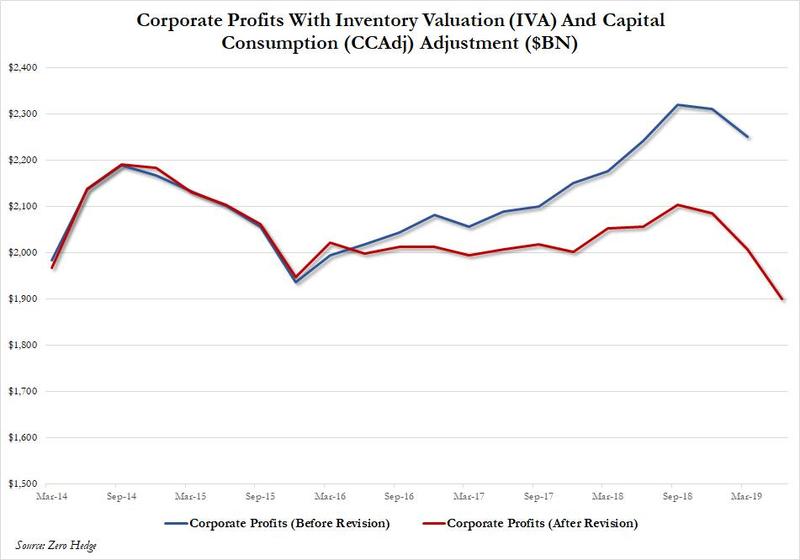

However, it was the annual revision to US national accounts that showed a significant change in two key items.

On one hand, there was a substantial upward revision in labor compensation. This, according to JPMorgan, is encouraging as it promotes a necessary normalization in labor’s income share and breathes life into the wage Phillips curve relationship.

However, this was more than offset by negative revisions to US corporate profitability showing a sustained decline in US corporate profits, which have slumped to the lowest level in over 5 years even as the S&P has risen by 50% in the same period, indicating that all of the upside in the stock market was due to PE multiple expansion, something Goldman discussed earlier.

http://feedproxy.google.com/~r/zerohedge/feed/~3/jCrmutNN_zg/us-corporate-profit-margins-revised-financial-crisis-lows

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.