Authored by Wolf Richter via WolfStreet.com,

Story stocks, momentum stocks, hyperventilation stocks, consensual hallucination stocks, financial engineering stocks: anything but reality.

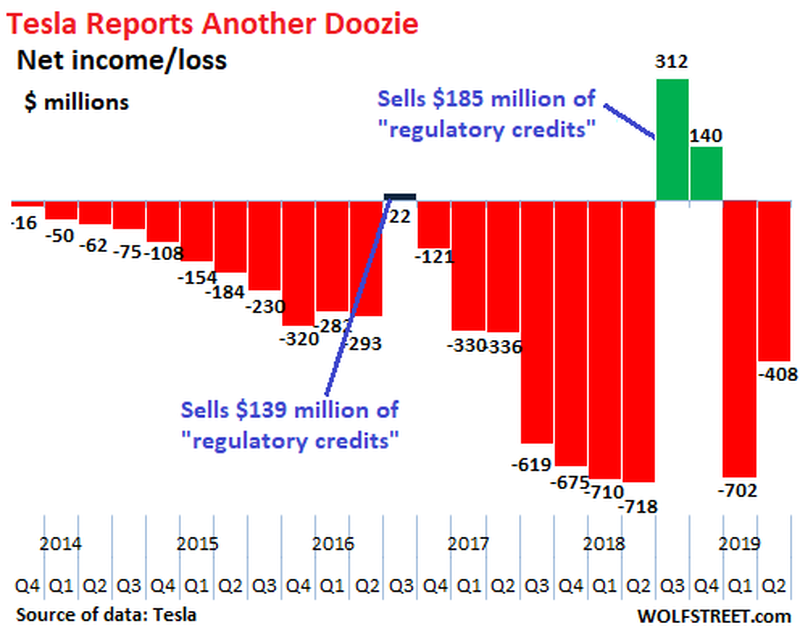

You see, Tesla is different. It just reported another doozie, a loss of $408 million in the second quarter, after its $702 million loss in the first quarter, for a total loss in the first half of $1.1 billion. In its 14-year history, it has never generated an annual profit.

It has real and popular products and surging sales, but it subsidizes each of those sales with investor money. And hereâs where itâs different this time: investors donât care. They dig how the company has been consistently overpromising and underdelivering. They dig the chaos at the top. They dig everything that should scare them off.

Yeah, its shares plunged 11% afterhours today, but that takes those shares only down to where theyâd been on May 1. Big deal. Shares are down 32% from the peak. But their peak should have been a small fraction of that. Even today, the company is still valued at over $40 billion.

Tesla lacks a viable business model in the classic sense. Its business model is a new business model of just burning investor cash that it raises via debt and equity offerings on a near-annual basis because investors encourage it to do that, and love it for it, and eagerly hand it more money to burn, and theyâre rewarding each other by keeping the share price high. Itâs just a game, you see. And nothing else matters.

Then there is Boeing. It just reported the largest quarterly loss in its history of $2.9 billion due to a nearly $5-billion charge related to its newest bestselling all-important 737 Max, two of which crashed, killing 346 people, due to the way the plane is designed. The flight-control software that is supposed to mitigate this design issue is not working properly. And a software fix that is acceptable to regulators remains elusive.

The plane has been grounded globally since March. No one, especially not the regulators, can afford a third crash. So today, Boeing announced that it may further cut production of the plane or suspend it altogether if the delays continue to drag out. This is big enough to start impacting US GDP.

The entire 737 Max episode has been tragic from the first minute, and the cost in human lives has been huge, and it has cost and continues to cost billions of dollars to deal with, among calls that the plane should never fly again.

And what does Boeingâs share price do? It dipped 3% today and is up 2% from a year ago, before all this happened. In essence, two crashes and the grounding of its bestselling plane, and the potential suspension of production of this plane, and its uncertain future ⦠and the stock has ticked up over a 12-month period.

Instead of spending the resources necessary to design a modern plane from ground up, Boeing kept basing its new models on versions of its many-decades-old 737 airframe that wasnât designed at all for what it is being used for today. This was a decision Boeing made to save some money and pump up its share price.

thats what the boeing guy i talked to said also.................

But here we go: From 2013 through Q1 2019, Boeing has blown a mind-boggling $43 billion on share buybacks (buyback data via YCharts):

more,,,,,,,,,,

http://www.zerohedge.com/news/2019-07-25/i-got-it-nothing-matters-its-whole-market-has-gone-nuts?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.