Authored by Constantin Gurdgiev via True Economics blog,

Markets are supposed to be efficient.

At least, on the timeline that allows to price in probabilistically plausible valuations of the firms.

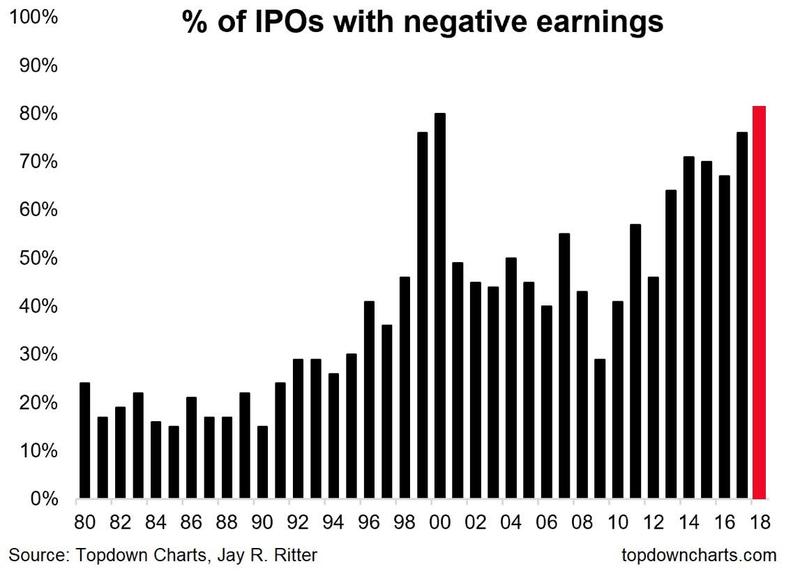

Markets failed to be efficient at the time of the dot.com bubble. And, it appears, they are back at the same game:

As the chart above shows, share of IPOs issued at negative earnings (companies losing money) is now at the levels last seen during the height of the dot.com bubble.

What can possibly go wrong?

http://www.zerohedge.com/news/2019-04-10/rewarding-reckless-risk-pricing-again?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.