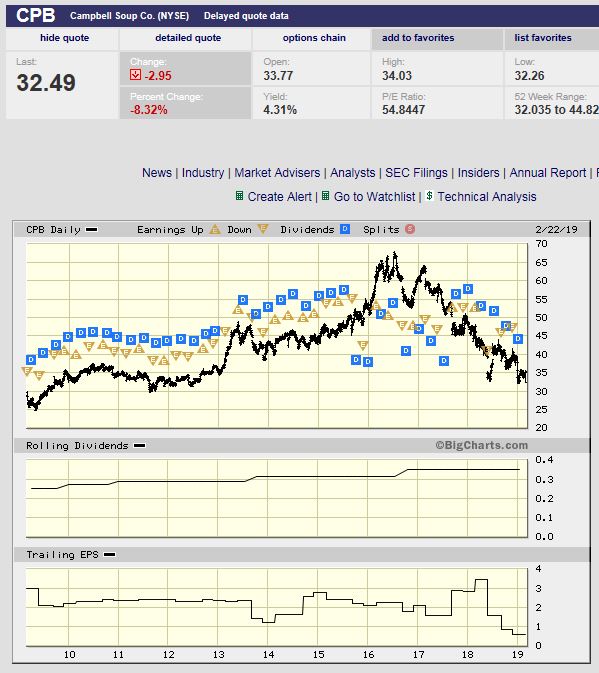

Note that I like a ten year chart.

Captain,

do your charts tell you to unload Campbells?

I do own some Campbells . . . but at the moment I am in a hold, wait and see.

>>>

What's Wrong With Campbell Soup?

http://seekingalpha.com/article/4180730-wrong-campbell-soup

Jun. 11, 2018

Summary

â¢We love Campbell Soup, the company, its history and the feel-good nature that its brand showcases.

â¢It will take a massive disruption to derail its business, but the company is facing considerable gross-margin pressure and now is considerably leveraged as a results of acquisitive activity.

â¢Investors have forgotten about its dividend cut in 2001, but Campbell Soup's dividend once again may be jeopardy in coming years.

â¢Though shares are starting to look cheap, we're having a difficult time getting excited about the stock. We're inclined to stay on the sidelines.

>>>

Article does continue. Zim.

Also, according to my weekly report, Campbells currently

is making less money than it is paying out in dividends.

EPS of fifty nine cents, versus annual dividend pay out of $1.40.

Zim.

Mad Poet Strikes Again.