GOOD QUESTION

The most perplexing aspect of the post-Christmas stock rally, which has sent the SPX almost 20% higher from its December lows, continues to confound investors.

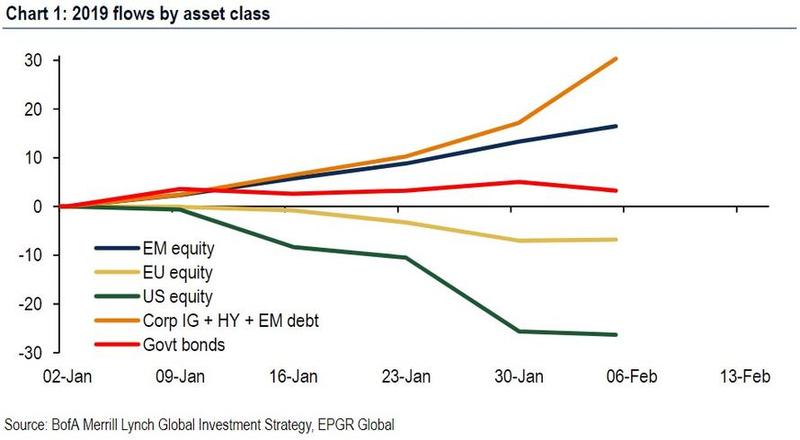

As we discussed last week, and the week before that, one of the more bizarre observations to emerge over the past nine weeks has been that despite the torrid rebound in stocks so far in 2019, culminating with the best January for the S&P since 1987, investors have shunned US equities, selling stocks when they should be buying, and allocating the proceeds into "yielding" instruments such as bonds and emerging markets, as the following recent chart from Bank of America demonstrated.

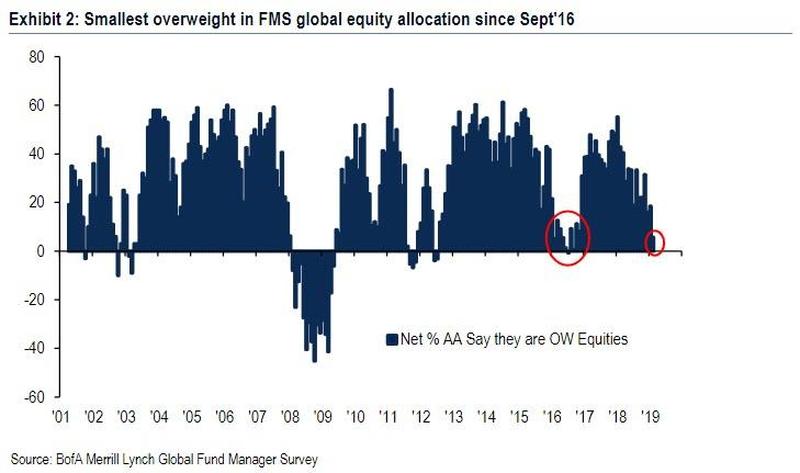

This was confirmed by the latest Fund Managers' Survey from BofA, which found that the allocation to global equities tumbled 12% to just net 6% overweight in February, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan'19 survey) to Feb 7th (end of Feb'19 survey) on record. This confirms that neither professional nor retail investors have any faith in the current rally.

http://www.zerohedge.com/news/2019-02-22/how-are-markets-higher-buyers-strike-continues-12th-straight-week?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

MACD confirms buying has dried up on the way up. Manipulation galore.........I say the blue line on the MACD drops down through the red line early next week, with the other indicators as well.........

unless, of course the machines do what they do on NOTHING haha ALGOS/HFTers get their 1/2 penny per share rebate/commission, they give a rats ass if it goes up or down. They making a fortune.......

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.