We discussed the collapse in the VIX earlier, when we pointed out that at least according to the world's largest bond manager, this artificial market calm foreshadows another surge in volatility just around the corner, which is also why Pimco's CIO had one recommendation: start selling now.

However, while Pimco may be accused of merely talking their book, there is another empirical indicator which suggests that a violent market reversal may be imminent.

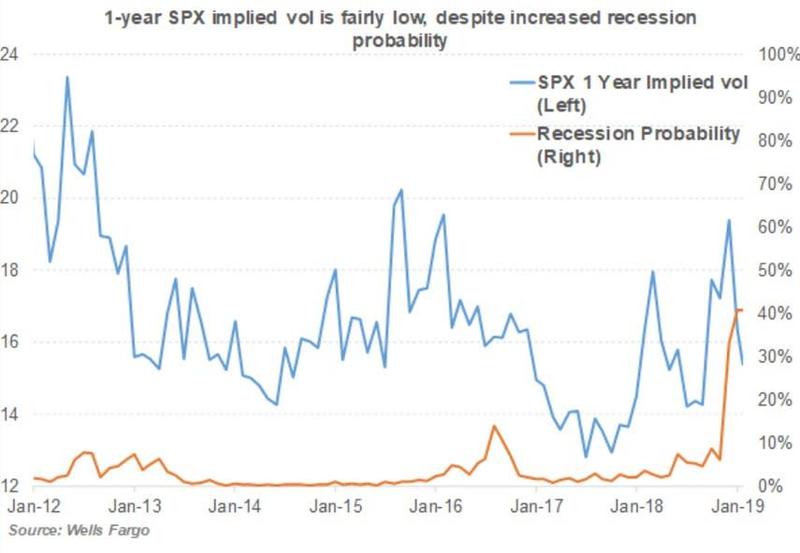

According to Wells Fargoâs recession model, which similarly to JPMorgan's and Goldman's uses various market signals such as the 3M10Y treasury spread and various economic inputs, the chances of a recession in the US over the next 12 months spiked in December and hit 40% in January (while high, this is still well below JPMorgan's 60% odds of a recession in the next coming year).

However, as Wells Fargo's in house derivative strategist Pravit Chintawongvanich observes, this surge in the probability of a recession is at odds with the implied one-year equity volatility which as discussed earlier, is now trending below its 2018 average.

"Despite the increased recession probability, long-dated equity volatility is actually trading lower than in previous years,ââ Chintawongvanich wrote in a client note, adding that the vol collapse likely reflects market structure issues (i.e., various speculators selling vol both directly and indirectly) rather than outright complacency.

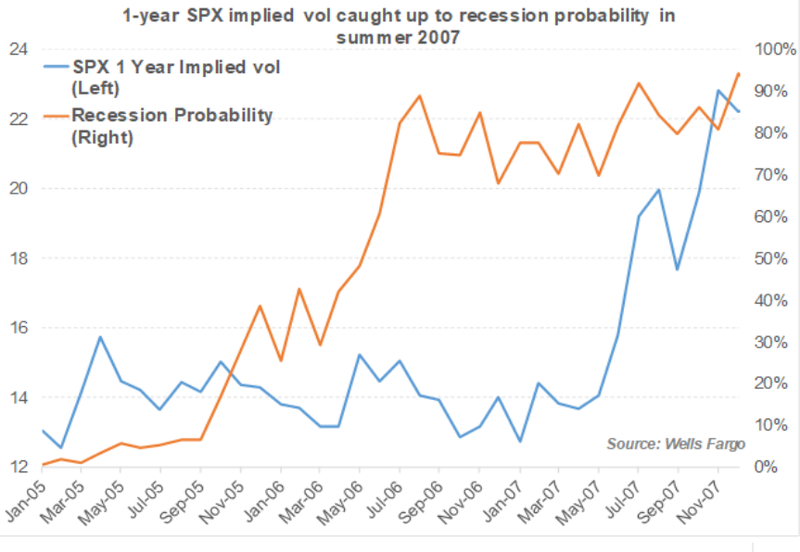

Yet while on the surface this is merely the latest discrepancy in a market where nothing makes sense anymore thanks to central bank manipulation of every asset class, according to Chintawongvanich the divergence has more ominous overtones: a similar gap emerged just ahead of the 2008 financial crisis.

"In 2007, 1-year vol traded at very low levels despite recession risk having increased rapidly in 2006," said Chintawongvanich adding that "It was only when Bear Stearns started running into trouble in summer 2007 that 1-year vol rapidly repriced."

http://www.zerohedge.com/news/2019-02-21/last-time-divergence-emerged-was-just-2008-crash?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.