Before I go into technicals further below let me just make some statements of principle: This channel will not sustain for the rest of the year, it will break and it will get challenged. Let me further suggest that the larger structure we are witnessing here is not that of a stable bull market. Itâs a complete mess, itâs unstable, itâs got all kinds of technical issues one of which being the mechanism by which price discovery is achieved and I want to address some of this today, both structurally, philosophically, but also technically, so bear with me.

Letâs talk valuation process:

In a former life during the Nasdaq bubble I was heavily involved in international M&A projects and greenfield opportunities (Asia, Europe, Africa, South America) for a multi-billion corporate entity. Our task was to not only identify and pursue value creating opportunities, but to develop a well founded perspective on how to value these opportunities. We needed to know how much we could reasonable bid for these opportunities (in many cases these were multi-billion dollar opportunities), but also what our cut off point was. To that end we needed solid business plans founded not only on a solid understanding of future revenues, expenses, but also future EBTIDA, free cash flows, debt to equity, WACCs (weighted average cost of capital) and a whole host of valuation metrics. Yet, at the end of the day, no matter how realistic one thought a business plan was, there were unknowables and uncertainties. Worse, any final valuation could easily be changed by one variable, the terminal value multiple. Frankly it was a wag (wild ass guess), largely influenced by how confident or skeptical senior management was in regards to a specific opportunity.

And before you knew it what was a months long rigorous valuation exercise, including on site and in country research, quickly became secondary to the terminal value multiple. We want in, or we donât want in, and in a competitive field of players playing the acquisition game valuations suddenly disconnected farther and farther from the original business plans creating a reality gap.

The point of all this? As Iâm watching stock markets these days I sense a similar process of disconnect. How do you value what a stock should be worth? Earnings growth right? Which earnings? GAAP or non GAAP? GAAP accounting has long taken a backseat to non GAAP accounting. We donât account for bad news here, things we donât like are shoved into non GAAP accounting. Itâs just a one time thing. And the next thing is just a one time thing too. And so on. And hence things we donât like get pushed aside.

When stocks report earnings prices often react favorably when stocks beat on EPS. What makes an EPS beat these days? Well, firstly itâs all about expectations and Wall Street generally takes EPS estimates down during any given quarter, making it easier for companies to beat. âOh look they beat EPS itâs bullishâ, no matter that EPS estimates were originally much higher at the beginning of the quarter. That negative trend is not accounted for. What matters is that they beat lowered expectations.

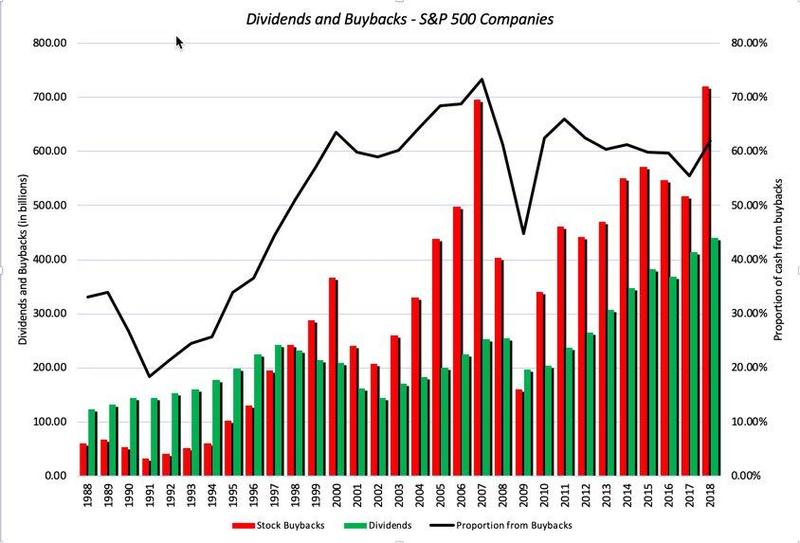

But are we even get a real view of EPS these days? Fact is buybacks keep reducing the float and EPS look better and better by the simple virtue of math as the same earnings divided into fewer shares show a higher EPS result. Magic.

And buybacks have been soaring again:

LOT MORE,,,,,,,,,,,,,,,,,,,

http://www.zerohedge.com/news/2019-02-18/caution?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.