The worst ghost inflation I have ever seen. They are REAL good at hiding reality!!!!!!!!

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

Submitted by Taps Coogan on the 3rd of February 2019 to The Sounding Line.

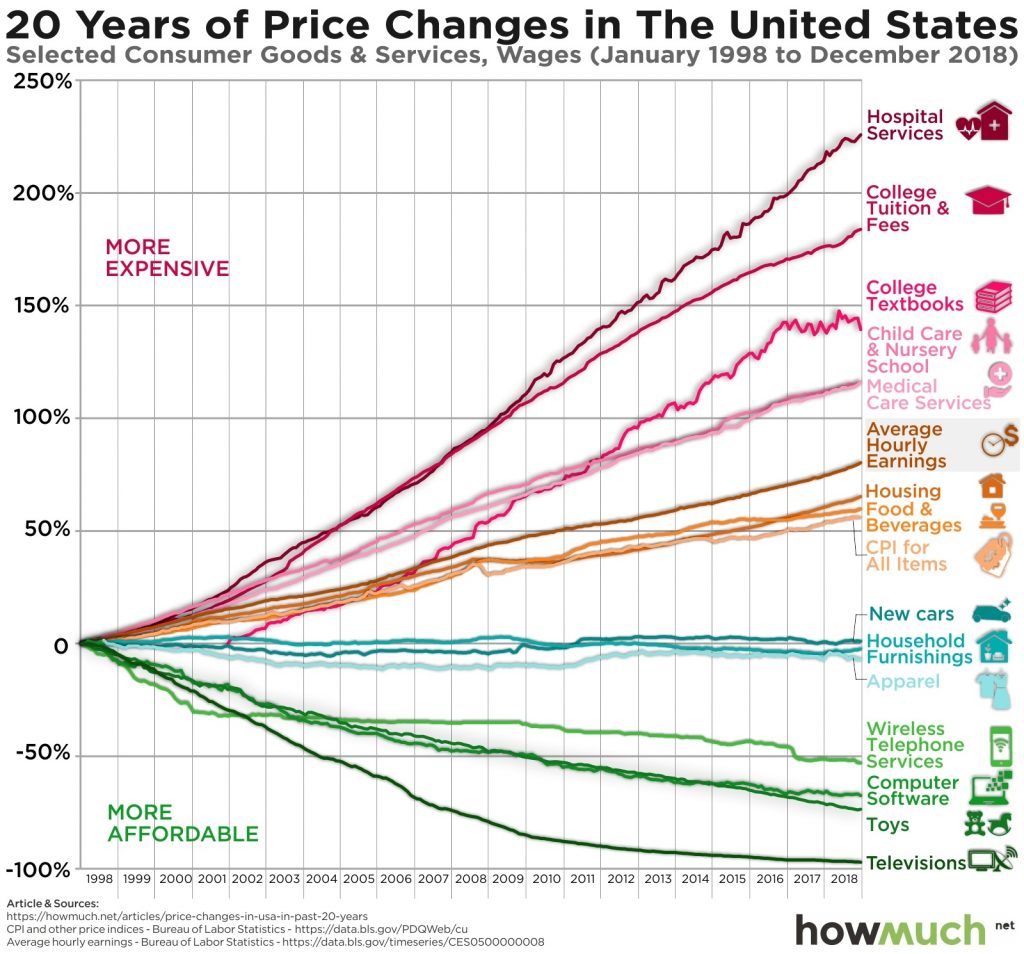

The following chart, from the cost estimation website HowMuch.net, helps visualizes a reality that has plagued most Americans for the past couple decades: real price inflation is much worse than the headline CPI numbers suggest.

Based on CPI data and hourly earnings, the following chart shows the change in affordability of a range of common goods and services since 1998.

Official statistics suggest that the rate inflation has averaged a subdued 2.15% since 1998. In reality, the average inflation rate masks dramatic cost increases in the purchases Americans have the least discretion over.

Imported consumer goods like TVs, computers, toys, and phones have gotten significantly more affordable and more feature rich, largely thanks to the offshoring of American manufacturing to wherever labor is cheaper. To a lesser extent the same phenomenon has kept cars, furniture, and clothing costs roughly constant. Meanwhile, the price of anything that canât be imported from places like China has skyrocketed. Food, housing, medical care, child care, college tuition and textbooks, and hospital stays have all increased more than the core CPI inflation averages. Meanwhile, quality has remained flat at best. In other words, official inflation statistics donât look bad because they are using cheap consumer goods like toys and TVs to offset large price increases in more expensive and harder to do without things like housing, food, medicine, and education.

With the US now placing tariffs on many of the cheap imports that have kept the CPI numbers so low, one has to wonder how much longer the official headline inflation numbers, and the Federal Reserve, will be able to ignore the true rate of inflation.

NO SHIT!!!!!!!!!!!!!!

http://thesoundingline.com/why-inflation-is-much-worse-than-the-headline-numbers-suggest/