US companies are sitting on tons of cash, and are also spending tons in dividends and buybacks. As they continue to pay back shareholders, debt load â rising â moves front and center.

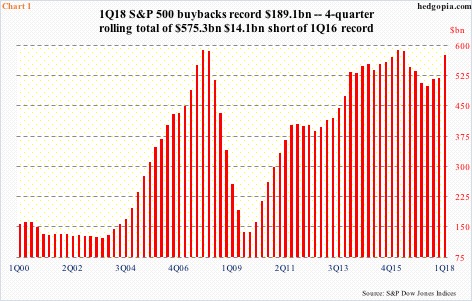

S&P 500 buybacks shot up to new record in 1Q18. Companies purchased $189.1 billion worth of their own shares, easily surpassing the prior quarterly record of $172 billion in 3Q07. In the current cycle, the prior high was recorded in 1Q16 when $161.4 billion was spent, subsequent to which buybacks came under pressure, dropping to $120.1 billion by 2Q17.

As a result, the four-quarter rolling total in 1Q18 came in at $575.3 billion, still lower than the all-time high of $589.4 billion in 1Q16. The latter was just about on par with the high of $589.1 billion recorded in 4Q07 in the previous cycle (Chart 1).

The Tax Cuts and Jobs Act of 2017, which was passed into law last December, provides for repatriation of overseas cash at favorable rates. The current pace of buybacks likely continues. Ditto with dividends.

http://www.investmentwatchblog.com/us-corporations-splurge-on-dividends-buybacks-cash-cushion-likely-shrinks-ahead/

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.