Submitted by Tyler Durden on 08/30/2012 20:02 -0400

HFT

Reg NMS

SPY

Volatility

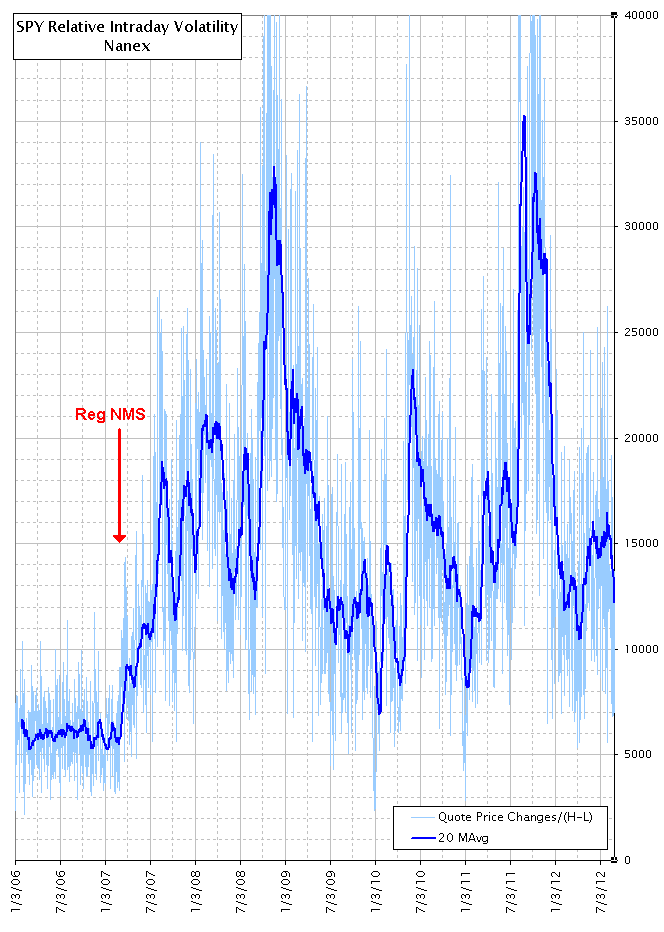

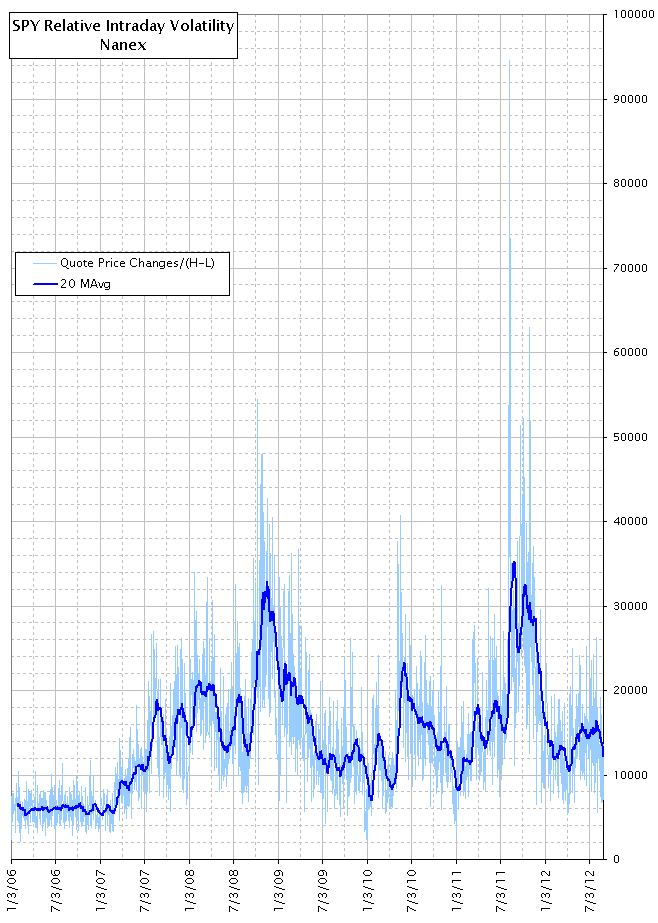

Sometimes a picture can paint a thousand words; in the case of these two charts from Nanex, it paints more as it is abundantly clear that since Reg NMS, the 'noise' in our daily trading markets has risen exponentially as the apparent price we pay for the 'liquidity-providing' machines is up to 15-times more normalized 'price-changes' - or put another 'smoothed' way: averaged over a 20-day period, intraday volatility has doubled since HFT began (and was six times larger during the flash crash). How's your mean-variance efficient-frontier look now? Or your delta/gamma hedging program?

Nanex ~ 30-Aug-2012 ~ SPY Intraday Volatility

For the symbol SPY, we took the number of NBBO (National Best Bid and Ask) price changes and divided that number by the trading session price range (high minus low). We call this ratio the Relative Intraday Volatility (RIV). We then plotted the RIV for each trading day from January 2006 through August 29, 2012 as shown in the chart below. The dark blue line is a 20 period moving average of the RIV. Notice how the year before Reg NMS was implemented, the RIV was very stable and flat. Since Reg NMS, the average Intraday volatility in SPY is twice as high today, and was nearly six times higher during August 2011. The second chart is scaled to include the entire range of data: note the August 2011 peak is 15 times higher than before Reg NMS.

1. SPY Relative Intraday Volatility from January 2006 through August 29, 2012

2. Same as chart above, but scaled to show the August 2011 peak.

http://www.zerohedge.com/news/charting-unprecedented-hft-driven-rise-intraday-trading-volatility?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.