Submitted by Tyler Durden on 07/31/2012 - 18:14 SPY

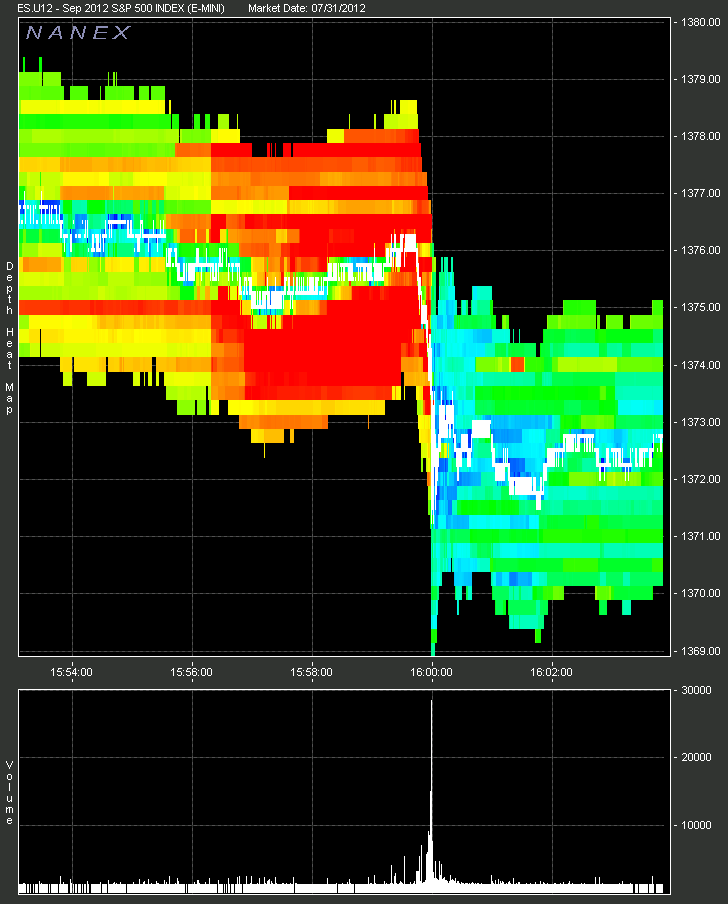

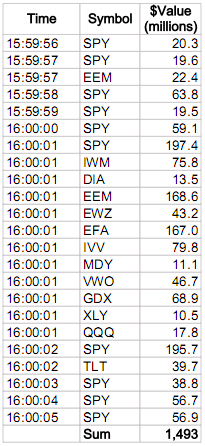

undefinedToday, three seconds before the close, someone was in a desperate hurry to dump 60,000 E-Mini contracts - the equivalent of $4.1 billion in underlying notional (ignoring the reflexive impact on various correlated assets and downstream synthetic instruments like ETFs and options). What happened next was a trade that was just shy of the size of the Waddell and Reed trade that the SEC said caused the flash crash. Luckily this time there was just 3 seconds of potential waterfall after-effects before the market closed. Had this happened at the May 6 blue light special time of 2:30 pm, the month end marks of US hedge funds and prop desks would have looked very different one day before the all too critical FOMC statement. The question remains: who waited to perform a reverse E-bay (inverse bid all in, in the last second of trading), and just what do/did they know? Below we present the complete 60,000 dump in its full visual glory courtesy of Nanex.

* * *

And where things get really interesting, is that what happened a few short hours ago, is virtually a carbon copy replica of an almost identical event which took place on July 31... 2011

On July 29, 2011, also the last trading day of July, Nanex noticed a eerily similar event and published a paper on it. A chart of SPY on that day is shown below.

Comments: 162

Reads: 13,703

John Law Lives

John Law Lives's picture

Thank you, ZH, for keeping us informed re. this sort of development. We sure wouldn't get this sort of analysis from the whoremongers who own the MSM.

Grazie!

http://www.zerohedge.com/news/visualizing-todays-last-second-60000-e-mini-contract-wipe-out

LOT MORE, pretty cool these sleuth chartest. They can find and read a chart to show the scams that go on everyday....

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.