Yikes! Look out below!

I'm glad to have my 401(k) money entirely in bonds. My Schwab account, though, has been hit hard.

The Fed's Message To Markets: Stocks Are Out, Bonds Are In

by: Eric Parnell September 22, 2011

SeekingAlpha.com

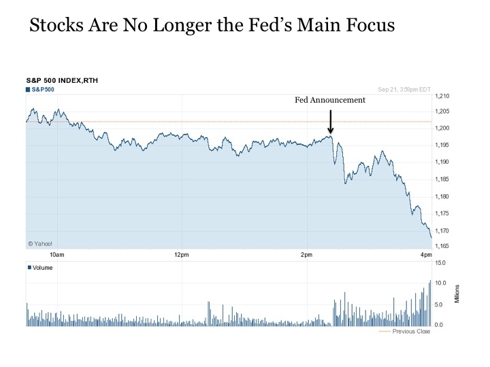

The reaction to the Fed statement spoke volumes about what we might expect from investment markets in the coming months. A look at the immediate reaction following the Fedâs announcement from four broad asset classes essentially tells the entire story.

Stocks

Stock investors seemed to finally start waking up to the fact today that the Fedâs strategy going forward is NOT focused on inflating the stock market. This fact should not have come as a surprise for several reasons.

First, past efforts to inflate asset prices have proved futile in sustaining economic growth. QE1 was initiated to save the global financial system and resulted in inflated asset prices, while QE2 was launched explicitly to inflate asset prices and create a wealth effect, and neither succeeded in achieving a persistent recovery. Thus, the Fed would be misguided in returning to this option once again this time around.

Second, balance sheet expansion by the Fed is the key in trying to inflate the stock market, and nothing in the Fedâs comments from the last several months have even suggested that they were considering expanding the balance sheet any further than they already have.

Third, the Fed is under increasingly wilting political pressure. Criticism has been mounting on the Fed for some time that their policy actions have not succeeded in generating an economic recovery and are instead undermining the integrity of the U.S. dollar. The latest was a letter sent by GOP leadership to the Fed asking that it abstain from further stimulus actions. The Fed does not want to compromise its independence with its policy actions. And given the possibility that Republicans could take control of the White House and the Senate in 2012, the Fed recognizes that it must act prudently to avoid any further political threat. Thus, it is likely that we will need to see extreme conditions before the Fed is willing to expand its balance sheet any further.

Lastly, the Fed needs to maintain some policy flexibility in the event of a crisis. The situation in Europe remains tenuous. As a result, the Fed needs to hold back its remaining policy resources so that it can intervene with stimulus in a more constructive way in the event that a contagion begins to unfold in global markets over the coming months.

Stocks must now stand on their own and rely on fundamentals to move from here. They can no longer rely on stimulus from the Fed to get another artificial run higher. Global economic and market conditions would likely need to deteriorate materially from here before the Fed would begin to even entertain QE3, but such an outcome implies far lower prices for stocks than where we are right now.

Bonds

The Fedâs strategy going forward is explicitly focused on the bond market. It tried two times with stocks to get the economy going and didnât work, so now itâs going to try with bonds. The priority for the Fed is to lower borrowing costs even further to stimulate activity in the credit markets

Click here for the exciting conclusion! http://seekingalpha.com/article/295295-the-fed-s-message-to-markets-stocks-are-out-bonds-are-in

Gold is $1,581/oz today. When it hits $2,000, it will be up 26.5%. Let's see how long that takes. - De 3/11/2013 - ANSWER: 7 Years, 5 Months