September 21, 2011

The Verdict Is In For Copper

by: Bob Johnson

SeekingAlpha.com

The Financial Times reported on Wednesday, September 21, that

Rio Tinto (RIO), one of the worldâs largest natural resources companies, has warned that some of its customers were asking to delay shipment of metals, in a clear sign that the financial turmoil is starting to hit the commodities sector.

Many factors constrain the supply of copper. The yield of many mines is dropping as the quality of ore decreases. That is, all the low hanging fruit has been picked in much of the world. Bringing a new mine into production is very expensive, from $2B up, and time consuming, on the order of three years. Further limiting factors are environmental concerns, hostile governments, labor actions and bad weather. All of these constraints on supply have meant there is no surplus of copper and production has been closely matched to demand keeping the price at historically high levels.

The largest consumer of copper by country is China, which is 40% of the world demand. Copper is being used at the customary rate in China and the rest of Asia. However, the same is not true for the rest of the world. There is a continuing, perhaps an increasing, slowdown in industrial production in the Western world. While September is usually the month that the volume of copper shipped hits its annual highs, the summer is over and itâs back to work, the demand is softer this year.

Copper is more sensitive to changes in the economy, due to its use in manufacturing and construction, than any other commodity. So, even with constraints on supply, demand can drop below production levels causing the price of copper to fall.

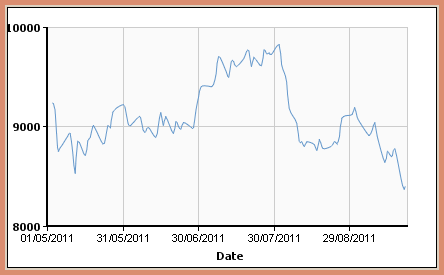

The verdict is in for copper. The optimism, which reigned from May through July, has been quashed. The price, as recently as the end of July at nearly $10,000 a tonne, is now at $8,500. Copper will continue to fall as the European financial system continues to falter and as is indicated by unemployment in the US, the recession continues.

Full article: http://seekingalpha.com/article/295050-the-verdict-is-in-for-copper

Gold is $1,581/oz today. When it hits $2,000, it will be up 26.5%. Let's see how long that takes. - De 3/11/2013 - ANSWER: 7 Years, 5 Months