Does this argument really make sense? I can understand shorting the markets. I can understand that a weakened economy leads to falling commodity prices.

But . . . gold isn't an ordinary commodity. Unlike the others, it doesn't ride economic strength. It is a bet that governments will betray the trust people have bestowed upon them.

In this day and age, when problems have become so plentiful, big and complex, that's a pretty good bet. Ever-more drastic and ill-conceived economic policies are on their way - not just here, but almost everywhere. Where, then, can people turn to preserve what they've already got?

Self. Business ownership. Farmable land. Gold. Silver. Guns and ammunition. Fuel. Liquor. Equipment. Art and collectibles. Those are the answers I've come up with.

At a time like this, with so many totally unpredictable government traps set and about to be sprung upon an unsuspecting public, I just can't see investing in things that aren't controlled by someone I trust. And "money," most certainly, is not under the control of anyone I trust.

Why would any thinking person trust bankers and governments which have given every indication that their long trends of economic mismanagement, increased expenses, invasive government, ineptitude and tyranny are ramping up toward some sort of massive blow-off?

I can't do it. I won't do it. Maybe you folks can. If so, please explain.

September 7, 2011

Precious Metals And U.S. Treasuries Aren't Good Bets Against The Current Uncertainty

by Bubble Bust Investing.com

Seekingalpha.com

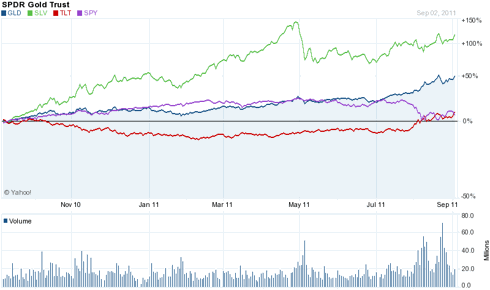

With the world economy heading for a double-dip recession and sovereign debt concerns growing, small and large investors are rushing to buy three assets that are considered a safe bet against uncertainty: gold, silver, and treasury bonds. This has sent iShares Silver Trust (SLV), SPDR Gold Shares (GLD), and iShares Barclays 20+ Year Treasury bond fund (TLT) soaring, while SPDR S&P 500 (SPY) has been heading in the other direction. But are these investments the right bets against the current uncertainty?

We donât think so. Precious metals are caught at the crosscurrents of a bearish trend (the recession), and a bullish trend (the sovereign debt crisis). Thatâs why they arenât good bets against the current uncertainty, especially after their big run up. iShares Silver Trust (SLV) is up 350 percent since early 2009; SPDR Gold Shares (GLD) is up 100 percent; and Freeport-McMoRan Copper and Gold (FCX) has soared 400 percent.

But there are good reasons to believe the commodity rally may be over. Monetary policy is no longer ultra-accommodating, and some have raised rates (China, Brazil, and India). The dollar is stabilizing, and the world economy may slide into deflation before experiencing any inflationary pressures. In addition, changes in margin requirements may limit the flow of funds into commodities.

Similar arguments can be made about U.S. Treasuries that are also caught between the bullish trend fueled by the prospect of a double-dip recession and the bearish trend fuelled by sovereign debt concerns. Here in the US, the prospect of further downgrades by major credit agencies, and the possibility of an unusually large fiscal stimulus loom large.

So what is the alternative?

Buy protection. Short or buy puts on SPDR S&P 500 (SPY). The problem, however, is that the S&P 500 has had a big correction already. So investors may want to average into this trade rather than going outright into a major position. They may want to do the same with iPath S&P 500 VIX Short-Term Futures ETN (VXX)--Buy VXX or buy calls on VXX to bet on rising volatility; short VXX or buy puts to bet on declining volatility.

Full story: http://seekingalpha.com/article/292113-why-precious-metals-and-u-s-treasuries-aren-t-good-bets-against-the-current-uncertainty

Gold is $1,581/oz today. When it hits $2,000, it will be up 26.5%. Let's see how long that takes. - De 3/11/2013 - ANSWER: 7 Years, 5 Months