Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

Years of monetary policy which has consistently driven yields lower, along with economic growth, have now left investors nowhere to hide from risk.

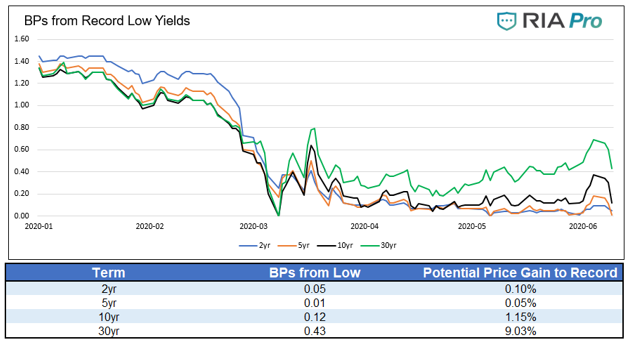

The graph above shows how many basis points benchmark U.S. Treasury securities are from their record lows. The table below the chart provides possible return scenarios if those bonds fall back to those records.

As you can see, the potential upside in most Treasury bonds is marginal at best.

Do portfolio managers understand the repercussions of such a return outlook? Simply, there is nowhere to hide.

http://www.zerohedge.com/markets/yields-approach-zero-bound-there-nowhere-hide?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.