One month ago, we thought that the unprecedented implosion in US commercial real estate in the month of April following the near-uniform economic shutdown following the coronavius pandemic, manifesting in the surge in newly delinquent CMBS loans would be one for the ages, even though as we predicted May would likely be worse as a result of the spike in specially services loans.

And indeed while April was catastrophic, May was even worse.

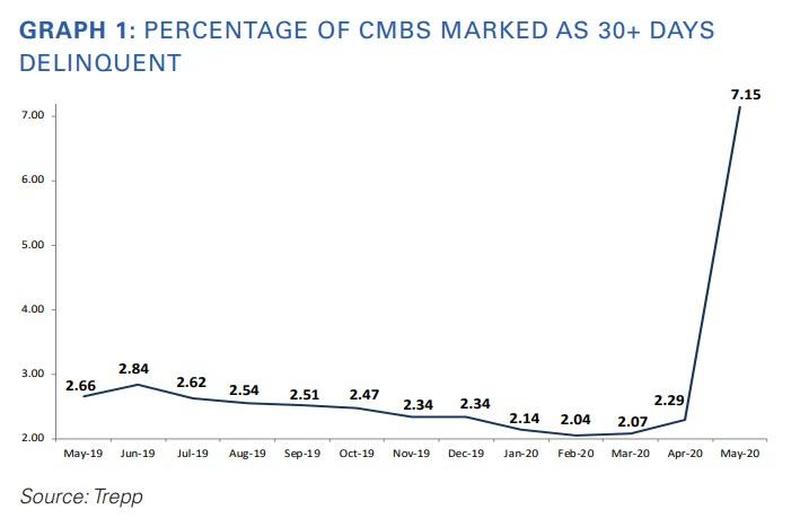

According to the latest remittance data by Trepp, the surge in CMBS delinquencies that most industry watchers were anticipating came through in May. After Trepp’s CMBS Delinquency Rate registered at 2.29% in April, in May the Delinquency Rate logged its largest increase in the history of this metric since 2009. The May reading was 7.15%, a jump of 481 basis points over the April number. Almost 5% of that number is represented by loans in the 30-day delinquent bucket.

YET the markets roar,,,,,,,,,,,,,,

http://www.zerohedge.com/markets/unprecedented-surge-new-cmbs-delinquencies-heralds-commercial-real-estate-disaster

Realist - Everybody in America is soft, and hates conflict. The cure for this, both in politics and social life, is the same -- hardihood. Give them raw truth.